On this page you can find the latest issue of the EAPA “Asphalt in Figures”, which summarises the production of the European asphalt sector in 2022.

The data refers to production, types of asphalt, applications, re-use/recycling rates, and the number of companies and production sites. These figures have been established with the assistance of the members of the European Asphalt Pavement Association, being at the moment the best available and most reliable data for the asphalt industry.

The figures were made available also in Excel format, making it easier for the reader to import and analyse the data in further studies.

EAPA members can also access the exclusive Members-Only Commented Version, in which not only the data, but the analysis of trends comparing countries and the data from previous years are also presented.

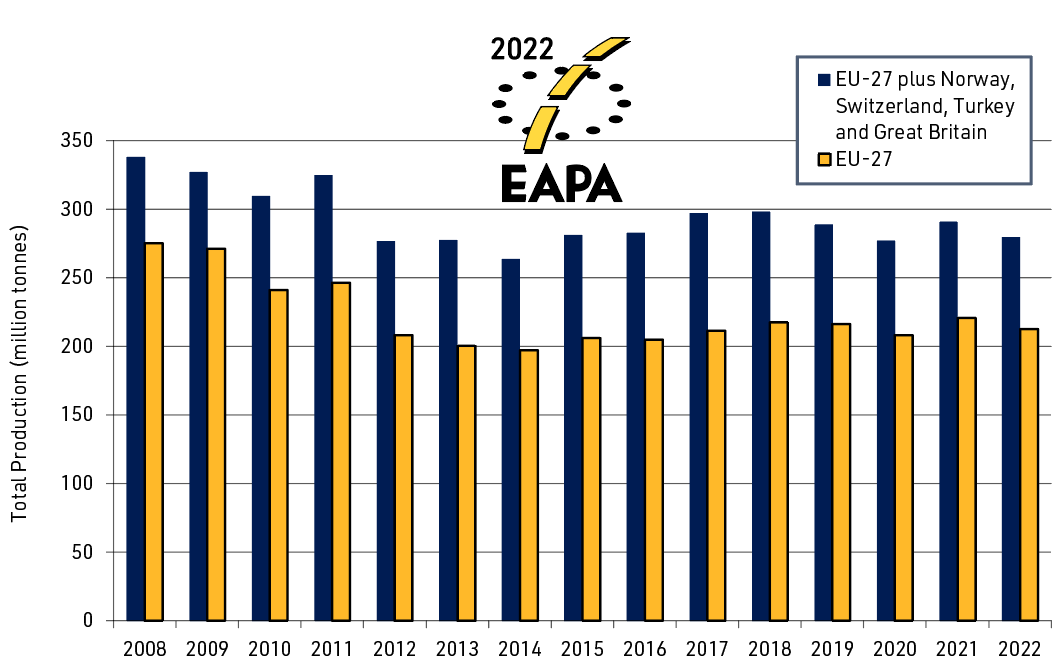

In 2022, the total production of Hot and Warm Mix Asphalt (HMA and WMA) was 212,5 million tonnes for the EU-27 countries and 279,4 Mt considering further countries in Europe (e.g. Norway, Switzerland, Great Britain and Turkey). Compared to the previous year, these figures represent decreases of 3,7% and 3,9% respectively, falling back to values slightly higher than those registered in 2020, characterised by the Covid-19 crisis (Figure 1).

Figure 1. Total Production of Hot and Warm Mix Asphalt in EU-27 and EU-27 plus Norway, Switzerland, Great Britain and Turkey, from 2008 to 2022

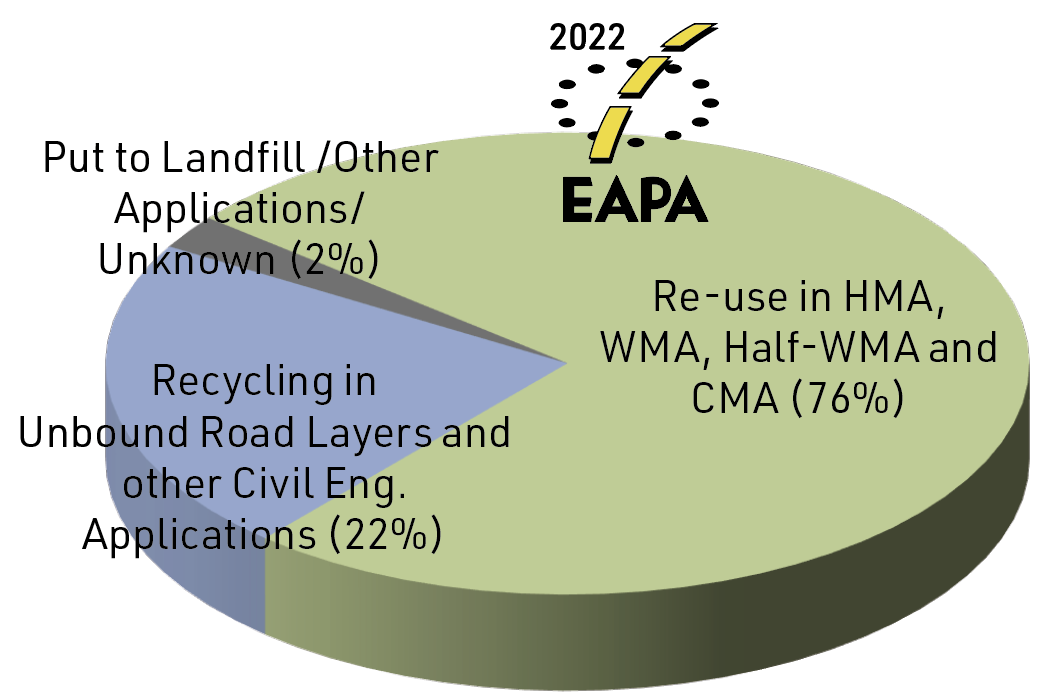

Figure 2. Application of reclaimed asphalt in fourteen European countries providing data

Figure 2 shows the percentage of available reclaimed asphalt, which was re-used for the manufacture of new mixes (including HMA, WMA, Half-WMA and CMA), recycled as unbound road layers and other civil Engineering applications, and utilized in other unknown applications or put to landfill. For the calculation of these values, only countries providing full data (total amount and use percentages) were considered. These European countries were Austria, Belgium, Croatia, Czech Republic, Denmark, France, Germany, Great Britain, Hungary, Norway, Romania, Slovenia, Spain and Turkey. In these countries, a total of 36,1 Mt of reclaimed asphalt were available, out of which, 76% were re-used, 22% were recycled and only 2% were used on unknown applications or put to landfill.